By

By

The rise of digital & mobile in insurance + how carriers are transforming themselves...

Back to Contents

Read it as a PDF

Following on from our previous post on Analytics and AI, we now turn to Digital Innovation – with a focus on the digital, mobile and cross-platform strategies being pursued by insurers as well as by other ecosystem players.

The following stats and perspectives are drawn from the extensive survey we conducted as part of our Global Trend Map; a full breakdown of our respondents, and details of our methodology, are available as part of the full Trend Map, which you can download for free at any time.

We saw earlier on, in our carrier priority tables (Insurance Map #3: Insurer Priorities), how Digital Innovation came out on top both globally and regionally in North America, Europe and Asia-Pacific; this also represented the service area in which investment from Insurers & Reinsurers was increasing the most. The way carriers approach digital and/or mobile has far-reaching implications not just for marketing and distribution but also for customer experience more broadly (claims, renewals and complaints are 3 obvious areas that spring to mind) and, ultimately, the whole business.

"Digital Innovation is not only about technologies and channels, Multi- or Omni-channel. Digital Innovation means you have to develop your insurance company to an open and digitally enabled platform which can interface with everybody every time in real time - from customers to brokers, to other insurers, but also to Fintechs and Insurtechs."

Oliver Lauer, Head of Architecture / Head of IT Innovation at Zurich

In general, we see companies’ digital, mobile and cross-platform focus increasing the closer they find themselves to end-consumers within the overall value chain, from Insurers up above to Distribution/Affiliate Partners on the ground. The overriding trend we encounter – and which we will encounter also in our future posts – is of insurers trying to get closer to their customers, moving from the back room to the front.

Download your complimentary copy of the full Trend Map here.

Does your organisation have a digital strategy?

The rise of digital channels and experiences has transformed many an industry already (just think retail), and insurance is not going to be an exception. Lacking a formal digital strategy is not the same as lacking digital capabilities, but it would appear a prerequisite for any company wanting to do more than just react to industry changes.

Digital action needs digital strategy- and insurance is no exception. Download your copy of the #InsuranceMap here: https://t.co/QH8z3aYH7y pic.twitter.com/Au7Ghca7Up

— Insurance Nexus (@InsuranceNexus) 26 July 2017

Does your organisation have a mobile strategy?

Most industries had barely begun to adapt to the strictures and opportunities of a desktop future, when the shift to mobile announced itself with a bang. We see this triumph of mobile reflected in many different measures, for example:

eMarketer recently announced that the majority of Google’s ad revenue in the USA now comes through mobile, not desktop.

While this new change has given rise to many mobile-specific functions within organisations, it is true that many have subsumed ‘mobile’ within ‘digital’ so as to avoid unnecessary silos in personnel and strategy.

First came #digital. But how are insurers coping with #mobile in 2017? Download your copy of the #InsuranceMap here: https://t.co/QH8z3aYH7y pic.twitter.com/Wpycx8Ine9

— Insurance Nexus (@InsuranceNexus) 26 July 2017

"Whenever you switch on a device or use an app, huge amounts of data are generated about your behaviour and lifestyle. These insights are critical because they can drive the overall business strategy and help companies design products to better meet the needs of our customers."

Dennis Nilsson, Assistant Vice President, Head of Advanced Analytics, Insurance, at TD Insurance

Download your complimentary copy of the full Trend Map here.

Does your organisation have a cross-platform strategy?

As we mentioned, organisations can approach desktop and mobile either with dedicated teams and strategies or under one broad ‘digital’ umbrella, and neither approach necessarily reveals much about that all-important factor: how well these digital channels are coordinated on the ground.

"Whether it’s filing a claim through an app on their phone or receiving a claim payment electronically to an app or to their bank account, or even just exchanging information like adding another vehicle to an Auto policy, today’s consumers don’t want to have to make phone calls and they don’t want to send emails. They basically just want to exchange digital information as quickly and efficiently as possible."

Stephen Applebaum, Managing Partner at Insurance Solutions Group

Whichever strategy they have chosen (‘digital’ and ‘mobile’ separate or combined), companies will live or die in today’s multi-device world by their cross-platform capabilities. The world’s best digital experience optimised for desktop stands to be wrong-footed by the on-going swing towards mobile; yet, at the same time, there are consumer segments and lines where ‘digital’ genuinely still means desktop. The optimal approach, we believe, involves catering for both, led ideally by market segmentation.

2017 is all about #digital convergence, and insurance is no different. Download your copy of the #InsuranceMap here: https://t.co/QH8z3aYH7y pic.twitter.com/8FW2oI3Yk7

— Insurance Nexus (@InsuranceNexus) 26 July 2017

While ‘digital’, ‘mobile’ and ‘cross-platform’ are useful concepts, they are too crude to capture the full spectrum of digital strategy, which is spilling out into every operational nook and cranny (albeit at different rates) as insurers look to transform the way they do business. So while, as we pointed out, digital strategies are currently more prevalent at the front end of the value chain (affiliate partners) than at the back (carriers), ‘digital’ will ultimately touch or subsume all aspects of the business.

"Both public and commercial consumers are increasingly digital, with many living their entire lives in cyberspace (commercial examples: Air BnB and Uber). Failing to address this with an equally agile proposition will result in the insurance sector's client base seeking alternative ways to transfer their risk. The market simply cannot live by the cliché 'it's worked this way for over 300 years...' if it hopes to retain relevance."

Gareth Eggle, Head of Insurance at Flint Hyde

In the past, the back end (the product) largely constrained the front end, but now that situation is reversed, with the digital needs of the front (the customer) driving transformation all the way through to the back. The distinction between front and back is therefore becoming increasingly superfluous (and often outright unhelpful) for insurers. Or, in other terms: if you treat your front-end digital, mobile or cross-platform strategy as somehow separate from your back-end systems and processes, then you are heading for disaster.

In order to explore the broader ramifications of ‘digital’ for carriers, we spoke to Denise Garth, SVP of Strategic Marketing, Industry Relations and Innovation at Majesco. Garth points out the many facets of the insurance business that must feed, and be fed by, the overarching digital strategy – and believes that the future of insurance is not ‘digital’ or ‘mobile’ per se but ultimately an all-encompassing ‘Amazon-like’ experience:

‘Today’s digital shift for insurance is moving from product-driven to customer-driven strategies; from limited distribution channels (such as agents) to an array of channels based on customer choice; from line-of-business silos to customer-centricity and customer experience for all products across all lines; and from siloed solutions focused on transactions to a platform portfolio that bridges together real-time interaction for all products and services for a customer, giving them an Amazon-like experience.

To create this new customer experience, insurers’ digital strategy must be more than a digital front-end, website or portal. First, it must be customer-driven. Second, it must be influenced from outside insurance.’

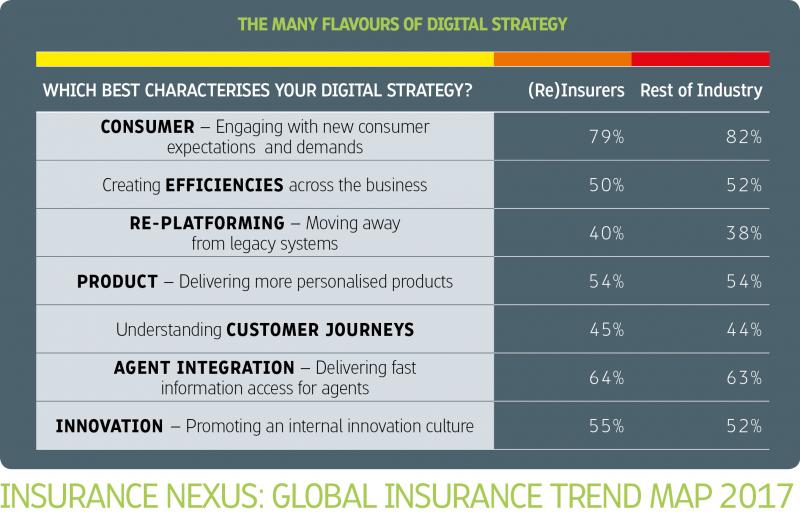

What is clear is that digital strategy is about much more than just channels, necessitating back-end transformation as well as a fundamental changes to company mind-set. To explore this further, we identified seven qualitative categories of digital strategy: ‘consumer’,‘efficiencies’, ‘re-platforming’, ‘product’, ‘customer journeys’, ‘agent integration’ and ‘innovation’, each one with a slightly different emphasis and different implications for the business as a whole. In the table below, we look at which flavours are currently finding favour with carriers, as well as with the industry more broadly.

"The value you hope to extract out of data will be stalled if you don’t have infrastructure. Many of us struggle because it’s hard to attach ROI to core infrastructure. You need a compelling vision for the future and some examples of current success to have the leadership fortitude to invest."

Catherine Bishop, Head of Insurance Strategy and Data at RBC Insurance

Download your complimentary copy of the full Trend Map here.

What flavour is your digital strategy?

We asked carriers around the world to say which out of our seven qualitative statements best applied to their digital strategies; this allows us to see where the industry is currently focusing, as well as how this may evolve going forwards.

The two stand-out flavours we see here are Consumer (first place) and Agent Integration (second place). Efficiencies, Product, Customer Journeys and Innovation all find themselves in a similar range, with Re-Platforming lagging behind.

"We think it’s very important for insurers to exist in three timelines at the same time. They have to mitigate the limitations of their legacy systems, they have to address current business needs – short-term, tactical business needs – and then they have to keep an eye on the future in terms of how technology is going to change their business tomorrow."

Matthew Josefowicz, CEO at Novarica

We have categorised the present disruption of the insurance industry as being fundamentally consumer-led, so it's no surprise at all to see the overwhelming majority of carriers emphasizing the consumer. This is totally in keeping with the overall priority allocated to Customer Centricity (2nd place on our carrier priorities table), the volume of third-party services being sought in the area of Customer Centricity and the prominence of the Chief Customer Officer role, all of which we saw in our earlier installments on Global Trends (Insurance Map #3: Insurer Priorities; Insurance Map #4: Services, Investments & Job Roles).

More unexpected perhaps is the second highest-ranked digital flavour, Agent Integration. What this tells us is that brokered channels are an integral part of being customer-centric and that, at least for now, customer-centricity is not all about the direct-to-customer channel. Many consumers in both personal and business lines continue to value indirect channels as part of their overall buying process – whether that be for researching the product, receiving expert advice or for sealing the deal.

The insurer who wins out will be the insurer who is able to adapt their channel blend to their market – not the other way round – and here we are talking not just about mobile versus desktop but the full range of physical channels as well. Encouragingly in this regard, we can see that the whole industry is broadly aligned in terms of the tilt it is giving to digital strategy, with the same flavours being favoured by the Rest of the Industry as by carriers.

"Sometimes we benefit from a ‘burning platform’ scenario, whereby a specific business problem accelerates the need for us to invest in technology. But normally, we find ourselves challenged in moving our data capabilities forward when the infrastructure costs are large and the benefits are uncertain or longer-term. It helps if you have a good strategy, and a good organisational culture around innovation."

Catherine Bishop, Head of Insurance Strategy and Data at RBC Insurance

Another point of interest is the relatively small focus on Re-platforming. When the subject of digital transformation comes up, it is easy to think about mega-projects and wholesale system replacements. In reality though, these are more often than not prohibitively expensive and high-risk, and carriers must proceed to a large extent via increments: there is plenty of low-hanging fruit to be had from rendering existing systems and processes more efficient and customer-centric...

Our next Key Theme will be the Internet of Things (IoT), a natural path of exploration for those insurers who have laid firm foundations in analytics, digital and mobile. If you'd like to read on straight away, and access all 11 Key Themes, simply download the full Trend Map free of charge.

For any inquiries relating to the Insurance Nexus Global Trend Map, this on-going content series or next year's edition, please contact:

Alexander Cherry, Head of Research & Content at Insurance Nexus (alexander.cherry@insurancenexus.com)

Forward to #7 Internet of Things >>>

<<< Back to #5 AI and Analytics